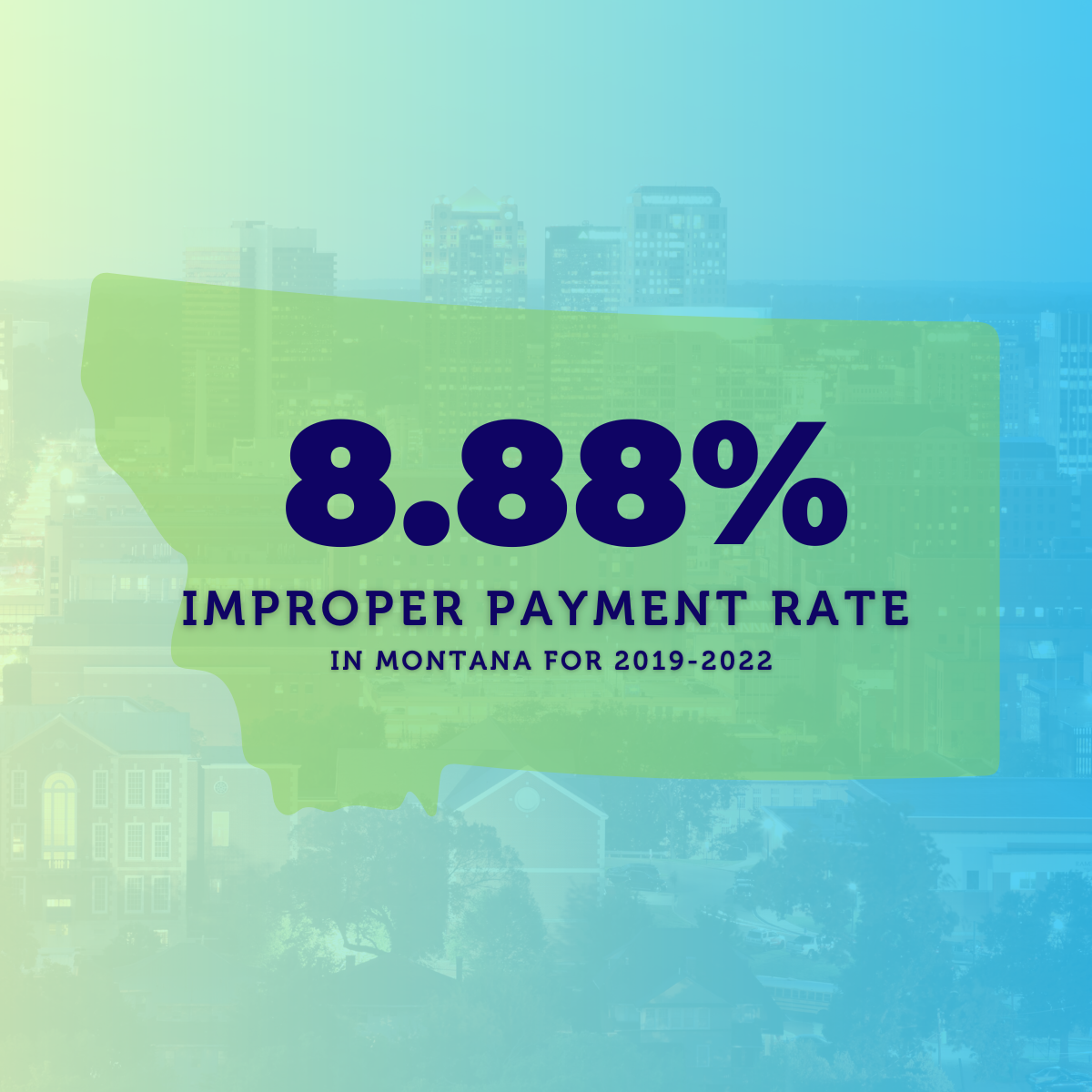

MONTANA UI

PAYMENT ACCURACY

What is an Improper payment:

Any payment that should not have been made or that was made in an incorrect amount under statutory, contractual, administrative, or other legally applicable requirements; and includes any payment to an ineligible recipient.

What are the causes of improper payments?

- Benefit Year Earnings: Claiming UI benefits after returning to work or failure to accurately report earnings

- Separation: Ineligible due to voluntarily quitting employment or discharge for cause.

- Work Search: Failure to actively seek employment.

- Employment Service Registration: Failure to register for referral to work or reemployment services

- Able & Available: Ineligible due to not being able to work or available for work.

- Base Period Wages: Error in calculating claimant's benefit based on wages earned prior to period of unemployment

WHAT Does this mean for employers?

State Unemployment Tax Rates are an employer's only controllable tax. By managing their unemployment claims properly, which includes responding to all requests for information timely and completely when protesting claims as well as auditing benefit charge assignments, employers are able to positively influence their SUTA tax rates and thus, minimize the impact to company's bottom line tax expense.

| MINIMUM SUTA RATE | MAX SUTA RATE | TAXABLE WAGE BASE | MINIMUM SUTA RATE |

|---|---|---|---|

| .13% | 6.30% | $32000.00 | $41.60-$2016 |

Get In Touch:

LEARN HOW UNEMPLOYMENT TRACKER CAN HELP YOU

Home Page

Thank you for your interest. Unemployment Tracker is now HRlogics UCM. Look out for an email from our team from an hrlogics.com domain.

Please try again later.