New Jersey Employers Alert: Unemployment Compensation Law Amendments To Take Effect July 31, 2023

Staying Compliant with Governor Phil Murphy's Latest Changes to New Jersey Unemployment Compensation Law - A Must-Know Guide for Employers

Starting July 31st, employers in New Jersey must adhere to new reporting requirements and should be aware of other significant changes introduced in the Unemployment Compensation Law. These changes introduce crucial updates to employer compliance and penalties for non-compliance. As an employer in New Jersey, it is essential to be well-informed about these amendments to ensure seamless adherence to the law. In this blog post, we will delve into the key amendments and their implications for employers.

New Reporting Obligations:

One of the most significant changes centers around new reporting requirements when an employee separates from work in New Jersey. Previously, employers were obligated to furnish separated employees with Form BC-10 upon their departure from employment. However, effective immediately, employers will have an additional responsibility. They must now electronically transmit the benefit determination information and a copy of Form BC-10 to the Department of Labor and Workforce Development (DLWD) while issuing the notice to the separated employee. To assist employers in fulfilling this obligation, the DLWD will release comprehensive guidelines outlining the necessary information to be provided, including details pertaining to disqualification from eligibility, such as voluntary leaving of employment.

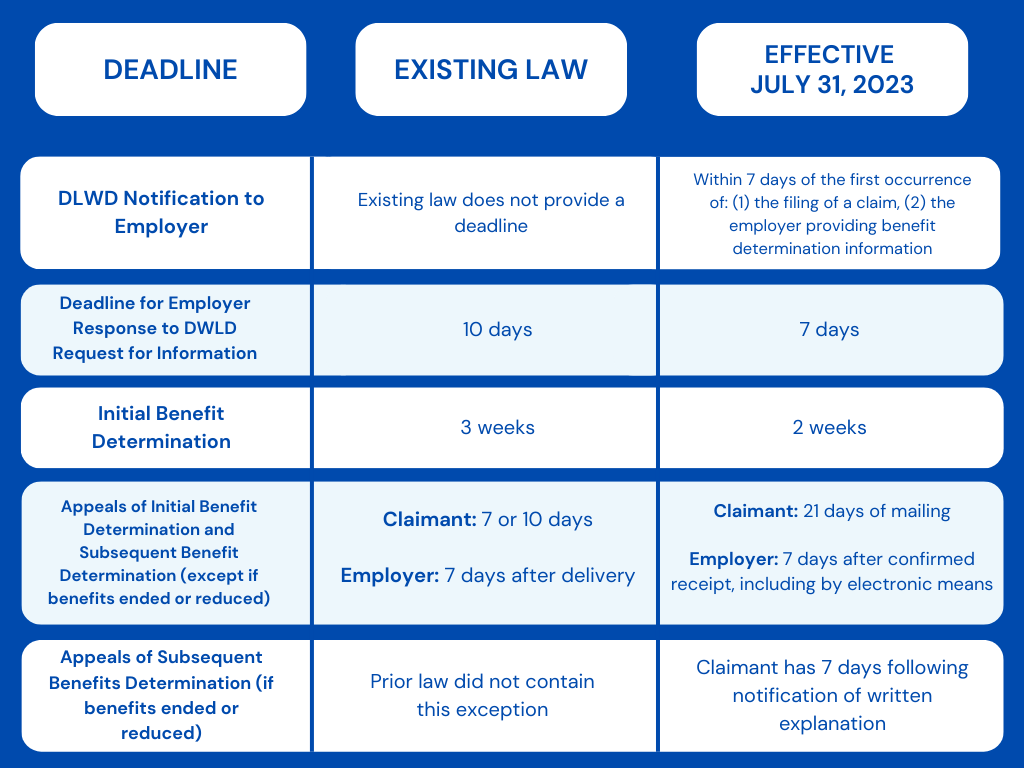

Revised Deadlines for Benefits Determination:

The second change in the amendments pertains to revised deadlines for the unemployment benefits determination process:

Increased Penalties for Non-Compliance:

Employers should be aware that non-compliance with the new reporting obligations and other provisions will result in more severe penalties. The previous penalty of $100 per day has been significantly amplified to $500 per day or 25% of the fraudulently withheld amount, whichever is greater. Furthermore, the scope of actionable offenses under the law has been expanded to encompass the failure to promptly provide information upon separation from employment, deviating from previous standards.

Remaining Aspects of the Act:

While the amendments address crucial aspects of the New Jersey Unemployment Compensation Law, some elements are yet to be finalized in terms of rules or administrative directives. For instance, employers must promptly provide the agency with information about an employee's separation from employment to facilitate benefit determinations. However, the specific information required by the agency may not always be immediately evident to employers or their representatives at the time of separation. This can lead to potential penalties, including charges to the employer's account. Employers should also note that appealing charges to their account after the 7-day appeal provision and providing information leading to an overpayment will not result in charges being waived.

Staying Ahead of the Changes:

The recent amendments to the New Jersey Unemployment Compensation Law are set to bring significant changes in employer compliance and penalties for non-compliance. As HR managers, it is essential to remain informed about these changes and proactively take steps to adhere to the new reporting obligations and deadlines. By understanding the implications of these amendments, employers can steer clear of penalties and ensure a smoother unemployment benefits process for their workforce.

At Unemployment Tracker, we are deeply committed to the success of our clients. As your trusted third-party administrator for Unemployment Cost Control, we are here to assist you in navigating these new requirements seamlessly, allowing you to focus on your core business objectives with utmost confidence. Our team of experts is ready to help you navigate through these changes and ensure your compliance with the New Jersey Unemployment Compensation Law. Get in touch with us today to learn how we can support you during this transition.